Update: in case there was any doubt about the ECB’s true intentions, we just got the official “denial”:

- DRAGHI: ANY ECB ACTION ON EU500 NOTE IS NOT ABOUT REDUCING CASH

Translation: the ECB action is only about reducing physical cash, some 30% of it to be specific.

* * *

The first shot in the global war on cash was just fired, by none other than the ECB, which moments ago Handelsblatt reported…

ECB wants to stop issuing 500 Euro bills – our exclusive https://t.co/LLe2qyhBjK

— Daniel Schäfer (@schaeferdaniel) February 15, 2016

… and Bloomberg confirmed – ECB COUNCIL VOTES TO SCRAP EU500 NOTE: HANDELSBLATT – has voted to scrap the second highest denominated European bank note in circulation.

… after the CHF 1000 note.

So what, big deal, eliminate it. The people will still have 5, 10, 20, 50, 100 and 200 euro bills right.

As we wrote just one week ago, the answer is not that simple at all. Recall that the €500 note is the second highest currency denomination in G10, after the CHF1,000 note. More importantly, the total value of €500 notes in circulation amounts to €306.8bn and has been rising…

End of quote.

Again, let’s recognise how so many moves are interlinked.

As the world moves towards a regime of negative interest rates, TPTB do not want people able to take their money out of the banking system as cash, thus saving themselves the cost of keeping it inside the system, which is what negative interest rates mean. It’s a good justification in (their) practical terms to eliminate cash and make all money electronic. This makes control much tighter and means they can easily take someone off the system by confiscating your money and shutting down your access to the system. Mind you, the current system doesn’t stop them, as Dr Rima Laibow experienced a year or so ago and Mark Phillips experienced back in the 80’s. But at least currently you can find ways around it.

Not when it’s all electronic.

It also means you can’t slip around their quietly enacted bail in legislation (activated In Europe and the US on January 1 this year) that has depositors becoming a low rated, unsecured creditor to the bank, which means when their high stakes gambling called derivative exposure goes bust, its depositors will fund their survival.

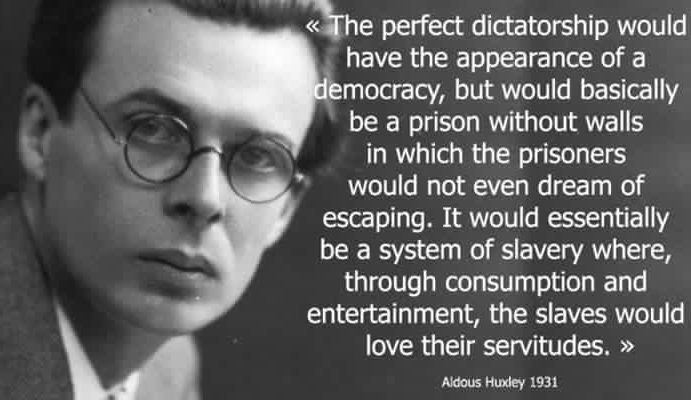

Paying electronically, whether with a credit or debit card, or Apple Pay or similar, is very convenient, and most don’t think about the risks in this system, as outlined above. It is all very easy when the prison bars are attractive to the inmates, and it’s all fine until they close the door and lock it, then throw away the key. Actually, most still won’t notice.

The modern smartphone has us buy our own personal tracking device that we would never accept if we were told we have to carry it with us at all times. You can be tracked to within a few feet.

I could give you many other examples.

Recent Comments